Fostering Infrastructural Development: BDEAC Bonds On Sale

- Par LIENGU ETAKA ESONG

- 16 nov. 2021 02:53

- 0 Likes

Business people have been urged to rush for theirs share as subscription for the bonds will ran from the 15 to 25 November, 2021.

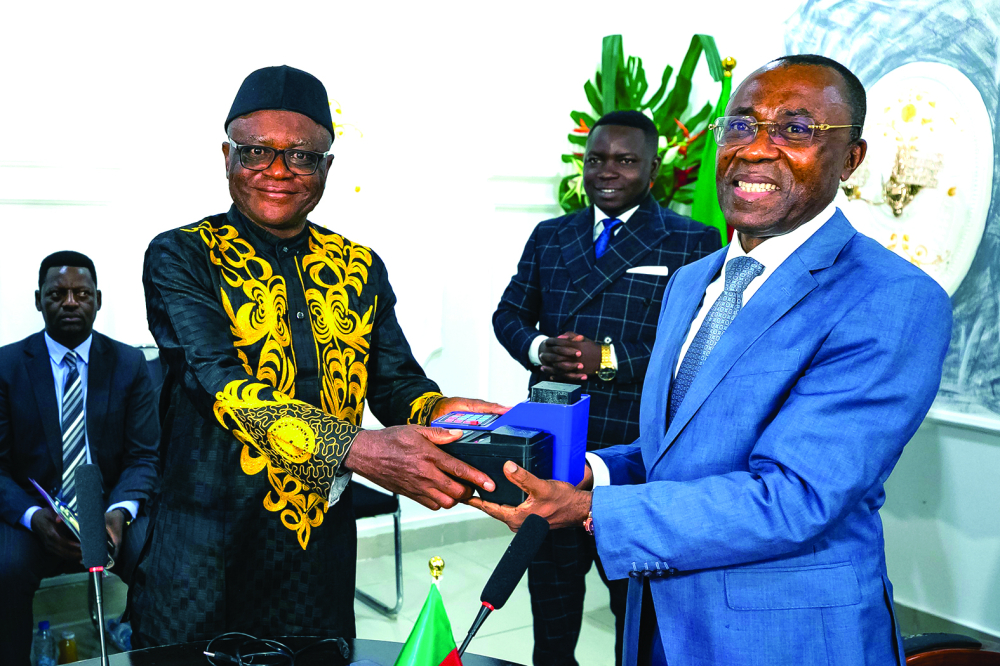

Bonds from the Development Bank of Central African States (BDEAC) dubbed "BDEAC 5.60% Net 2021-2028" were launched on Friday, November 12 in Douala. The operation, which is the second phase of a three-year programme, provides for the mobilization of resources of a global amount of 100 billion FCFA on the CEMAC financial market, at a rate of 10,000 FCFA the nominal value of a security for an interest rate of 5.60% net over the duration of the loan which is seven years. Subscriptions to acquire the bonds will ran from November 15 to 25 2021 at the stock exchange companies and banking institutions involved. During the launching ceremony, the President of the Development Bank of Central African States (BDEAC), Fortunato-Ofa Mbo Nchama explained that funds mobilised during the operation will be to foster development within the Sub Region. He also thanked investors within the CEMAC region for their decisive contribution to the financing of the sub-region's development. He went further and urged investors in Cameroon to rush for their own share of the bonds during this second phase in order to continue to contribute to the emergence of the economies and the improvement of the living conditions of the populations of Central Africa. Funds mobilized during the sale will be used to finance private and public sector operations, with resources adapted in terms of maturity, deferment and rate. In so doing, BDEAC will contribute with economic diversification, financial inclusion of the population and redistribution of proceeds. They will also make it possible to better finance the imple...

Cet article complet est réservé aux abonnés

Déjà abonné ? Identifiez-vous >

Accédez en illimité à Cameroon Tribune Digital à partir de 26250 FCFA

Je M'abonne1 minute suffit pour vous abonner à Cameroon Tribune Digital !

- Votre numéro spécial cameroon-tribune en version numérique

- Des encarts

- Des appels d'offres exclusives

- D'avant-première (accès 24h avant la publication)

- Des éditions consultables sur tous supports (smartphone, tablettes, PC)

Commentaires