“Tax Holidays, Exemptions Could Be Costly For Countries”

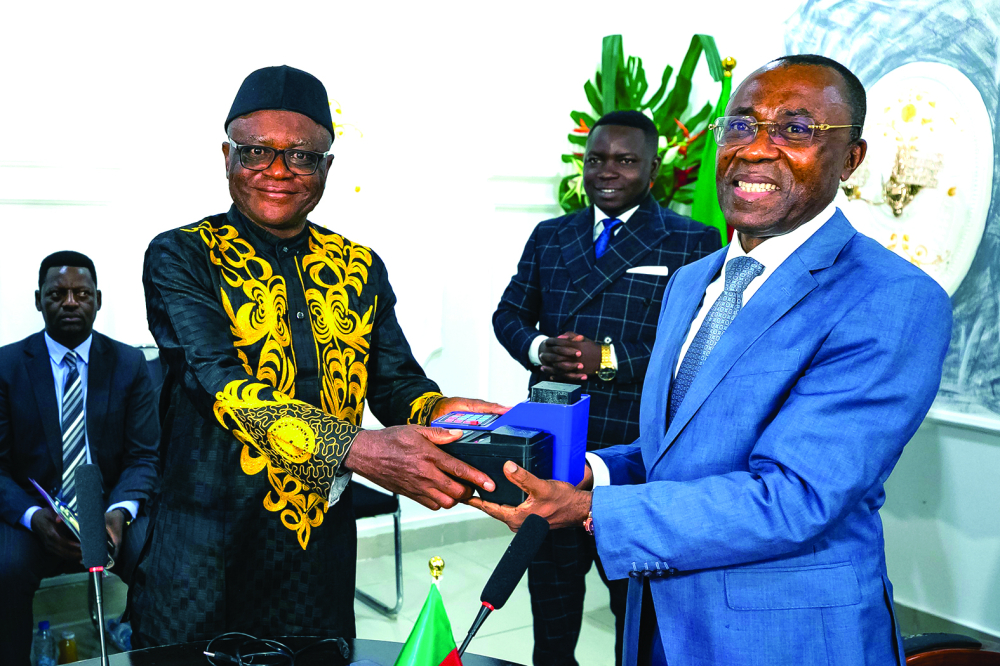

Roger Nord, Deputy Director, African Department of the International Monetary Fund

The fifth African fiscal forum has just ended in Yaounde with delegates advocating strong adjustments. What could have influenced the decision?

The background to this forum is a sharp decline in commodity prices - from oil to copper- with serious consequences to countries. Government revenues have fallen dramatically. We just discussed what to do in the wake of this crisis. We looked at both sides of the balance sheet. There is need to raise revenue and diversify the revenue base away from natural resources. We also looked at the expenditure side. We have to make sure that the scarce government resources are well spent, especially public investment that is a problem to many African countries.

One thing that is good with the conference is that we didn’t only talk on how countries should do. We talked about how to do it. We have a lot of experiences. About 30 countries represented in the forum were able to talk to each other and gain experiences on things that work and those that don’t. There is need to control the wage bill which can be very high in some countries and experts and government officials discussed how they handled the problem of ghost workers. It was useful to other countries too.

Diversifying revenue sources as well as spending wisely are not new concepts since the start of the double shocks. What are innovative ways to facing fiscal stress in Africa?

On the revenue side, the best thing is not to invent new taxes or higher tax rates. All we need is to have a better and closely neat tax method - that means closing loopholes and making sure that exemptions and other tax holidays are strictly limited. A lot could be gained in that way. On the expenditure side, a lot has to do with proper project evaluation, follow-up of projects and better control of public money. Those things could make a difference.

What are the implications of tax holidays to an economy?

Tax holidays for investors and tax exemptions for particular companies could be very costly for many countries. It can be 5-6 per cent of GDP to some African countries which is about 1/3 of revenue they raised got lost because of loopholes. Some of them make it quite useful but others...

Cet article complet est réservé aux abonnés

Déjà abonné ? Identifiez-vous >

Accédez en illimité à Cameroon Tribune Digital à partir de 26250 FCFA

Je M'abonne1 minute suffit pour vous abonner à Cameroon Tribune Digital !

- Votre numéro spécial cameroon-tribune en version numérique

- Des encarts

- Des appels d'offres exclusives

- D'avant-première (accès 24h avant la publication)

- Des éditions consultables sur tous supports (smartphone, tablettes, PC)

Commentaires