Mobile Money Scam : Fraudsters Multiply Strategies

- Par LIENGU ETAKA ESONG

- 22 Jun 2020 12:21

- 0 Likes

Mobile telephone network operators have intensified sensitisation on how to detect swindlers.

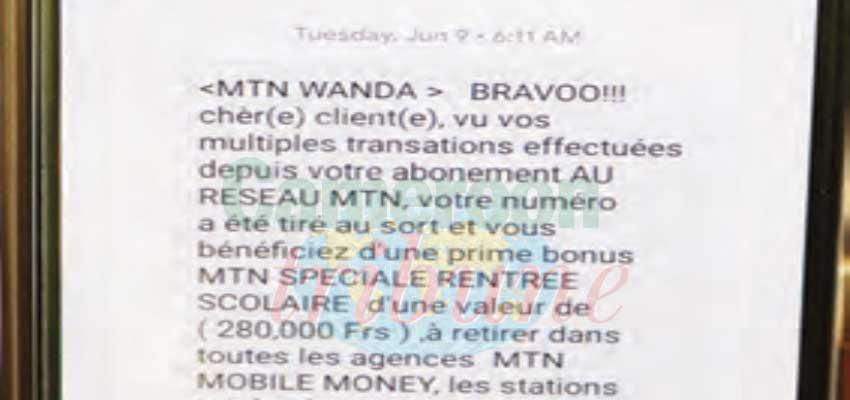

Of recent the phenomenon of mobile money theft is gaining grounds. As the days go by, scammers derive new strategies to extort money from their victims. Most often they claim to have mistakenly send money to a particular mobile money account and plead with the receiver to resend the money. Another strategy is by sending an SMS that one has won a lot while giving a contact number and name for the person to get the lot. At times most people fall victim while others simply outsmart them as well.

Linda Dikonge, a Douala city dweller recounts how she lost FCFA 100,000 to the fraudsters, “One morning I received a message instructing me to confirm the withdrawal of FCFA 100,000. Without a second thought, I confirmed with my code, after which I realised it was a scam. I tried getting back to the person to no avail”. On the other hand Frank Ndongo said once, he received an SMS that his mobile money account has been credited with FCFA 45,000, while he was still struggling to read the message, the sender called that it was an error that he should resend the money. Frank Ndongo said he simply copied the same SMS while reversing the name of the sender and the receiver and sent it to the same number and immediately the supposed sender called and insulting him.

Managing risk in mobile money is a challenging task, especially when it comes to the risk of fraud. Fraud not only results in financial loss to customers or a mobile money provider, but it also damages the reputation of the service to the customer and risks the reputation of the telecom company as a whole. As such, mitigating the risk of fraud is a primary objective in a robust risk management strategy. Mobile operators are familiar with mana...

Cet article complet est réservé aux abonnés

Déjà abonné ? Identifiez-vous >

Accédez en illimité à Cameroon Tribune Digital à partir de 26250 FCFA

Je M'abonne1 minute suffit pour vous abonner à Cameroon Tribune Digital !

- Votre numéro spécial cameroon-tribune en version numérique

- Des encarts

- Des appels d'offres exclusives

- D'avant-première (accès 24h avant la publication)

- Des éditions consultables sur tous supports (smartphone, tablettes, PC)

Commentaires